The Wage Tax is Not Constitutional

This page changed with the Apr 02, 2024 edit.

To move all ads to bottom of screen, shrink the window width

Be part of the success!

Help spread the word!

This page changed with the Apr 02, 2024 edit.

Both of them are tied to The Constitution of the United States of America, Amendment 16; which states:

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

As was done with 'census', in the previous page; the same happens here when it comes to wages and income, as it relates to Amendment 16, and what power exactly was granted.

The same warnings apply here as with the census page. Caution must be exercised when selecting the dictionary from which to define Amendment 16 words.

Old Dictionary Time:

What are wages and what is income?

When did Congress pass the proposed Amendment 16; in order for the States to consider its ratification?

Though the states ratified Amendment 16 in 1913; its content was being discussed in congress during 1909, the year it passed in Congress. For this, we compare 1828, 1898, 1916, 1960 and 2024 definitions.

Are wages and income synonymous?

First, all the definitions.

Income

1. That gain which proceeds from labor, business or property of any kind; the produce of a farm; the rent of houses; the proceeds of professional business; the profits of commerce or of occupation; the interest of money or stock in funds. Income is often used synonymously with revenue, but income is more generally applied to the gain of private persons, and revenue to that of a sovereign or of a state. We speak of the annual income of a gentleman, and the annual revenue of the state.

Notice: The gain which proceeds from labor... the profits of commerce or of occupation... the interest of money... the gain of private persons. Notice what is not here; yet. No mention of wages or salary, both connected to labor.

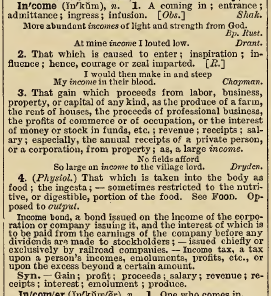

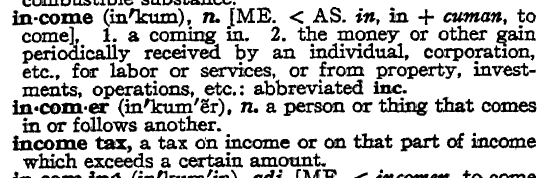

Income

3. The gain which proceeds from labor, business, property, or capital of any kind, as the produce of a farm, the rent of houses, the proceeds of a professional business, the profits of commerce or of occupation, or the interest of money or stocks in funds, etc.; revenue; receipts; salary; especially, the annual receipts of a private person or a corporation, from property; as a large income.

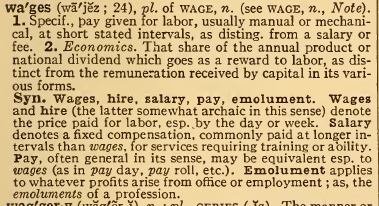

Notice: The gain which proceeds from labor... the profits of commerce or of occupation... the interest of money... Notice the inclusion of salary; but not yet, the inclusion of wages. Salary is paid to upper management. Wages to the unskilled laborer.

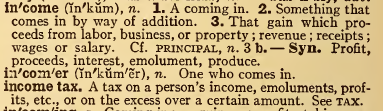

Income

3. That gain which proceeds from labor, business, or property; revenue; receipts; wages or salary.

3 b. —Syn. Profit, proceeds, interest, emolument, produce.

Income Tax

A tax on a person's income, emoluments, profits, etc., or on the excess over a certain amount.

Notice under Income: The gain which proceeds from labor...

Notice the inclusion of "wages or salary".

Critical!: Notice the two-part definition for income tax. Part 1: gains and profits. Part 2: excess over a certain amount. Though Part 1 also qualifies as Part 2; Part 2 does not necessarily qualify as Part 1.

IRS: Topic no. 401, Wages and salaries; states: "All wages, salaries and tips you received for performing services as an employee of an employer must be included in your gross income."

Consider that Congress, with the application of the income tax code, includes wages as income. Such declaration by Congress interferes with private contracts regarding the true value of labor as the compensation for labor. A compensation, as shown above in the definitions, is not a gain to the employee; by definition, it is not income.

Income

2. The money or other gain periodically received by an individual, corporation, etc., for labor or services, or from property, investments, operations, etc.: abbreviated inc.

Income Tax

A tax on income or on that part of income which exceeds a certain amount.

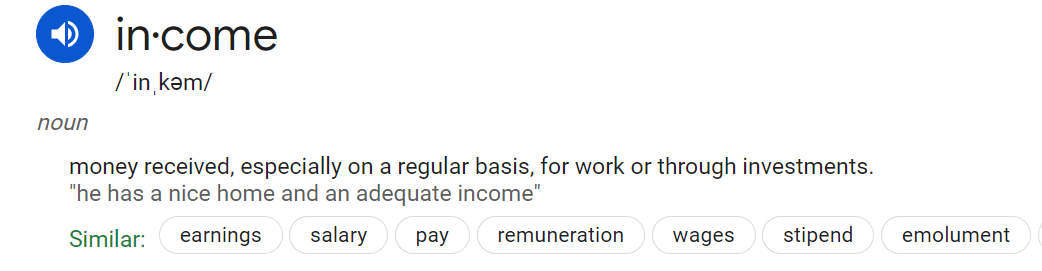

Income

Money received, especially on a regular basis, for work or through investments.

Wage

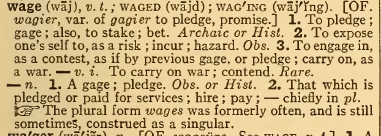

5. To take to hire; to hire for pay; to employ for wages; as waged soldiers.

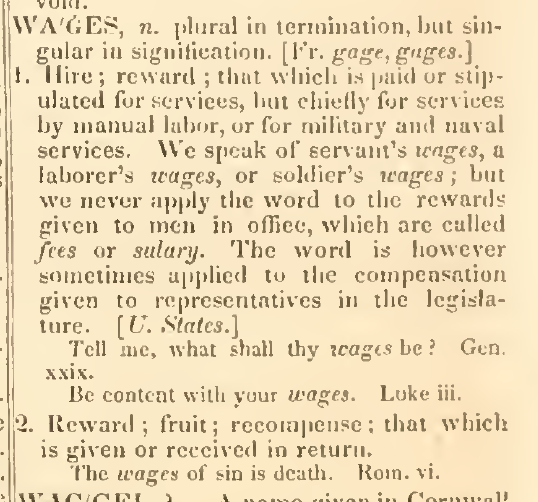

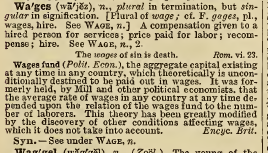

Wages

1. Hire; reward; that for which is paid or stipulated for services, but chiefly for services by manual labor, or for military and naval services. We speak of a servant's wages, a laborer's wages, or a soldier's wages; but we never apply the word to the rewards given to men in office, which are called fee or salary. The word is however sometimes applied to the compensation given to representatives in the legislature.

Wage

2. That for which one labors; mead; reward; stipulated payment; —at present, used in the plural. See Wages.

Wages

A compensation given to a hired person for services; price paid for labor; recompense; hire. See Wage, n. #2

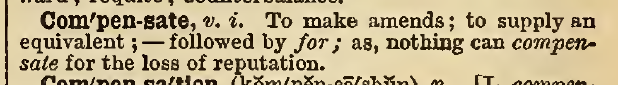

Compensate

To make amends; to supply an equivalent; —followed by for; as, nothing can compensate for the loss of reputation.

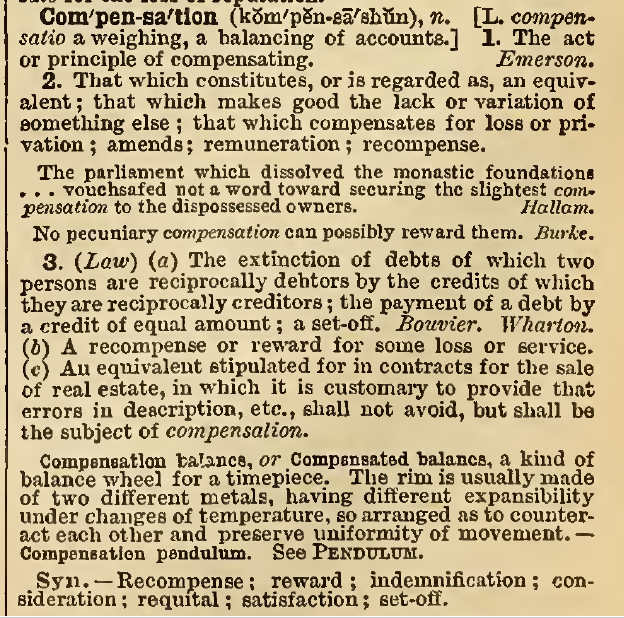

Compensation

2. That which constitutes, or is regarded as, an equivalent; that which makes good the lack or variation of something else; that which compensates for loss or privation; amends; remuneration; recompense.

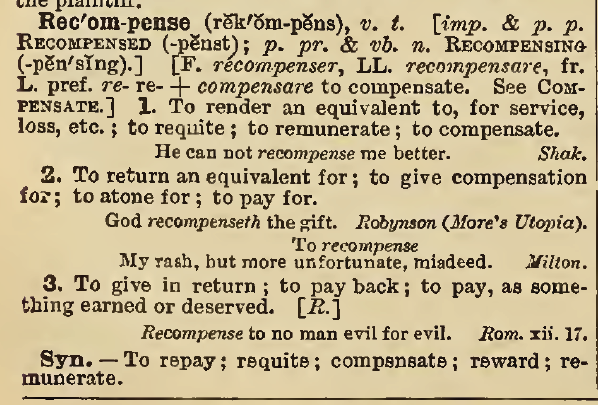

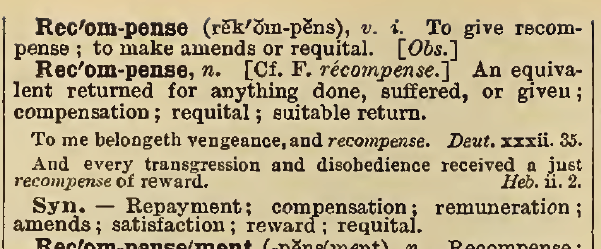

Recompense

2. v.t. To return an equivalent for; to give compensation for; to atone for; to pay for.

3. v.t. To give in return; to pay back; to pay, as something earned or deserved.

n. An equivalent returned for anything done, suffered, or given; compensation; requital; suitable return.

Note: Wages, so far, is nothing more than the employer repaying a debt to the employee for the labor they provided to the employer. Rarely does the employer make an equivalent return in cash for the services performed by the employee. Employees are rarely compensated the full value of the labor they perform. As such, the employee works to a financial loss, in comparison to the value of service provided.

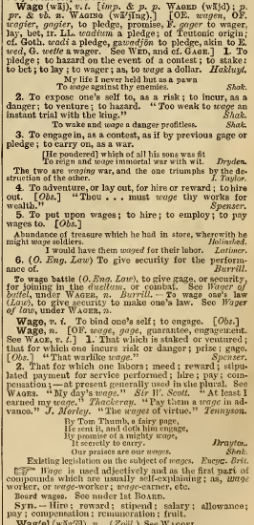

Wage

2-n. That for which is pledged or paid for services; hire; pay; chiefly in the pl..

Wages

1. Specif., pay given for labor, usually manual or mechanical, at short stated intervals, as disting. from salary or fee.

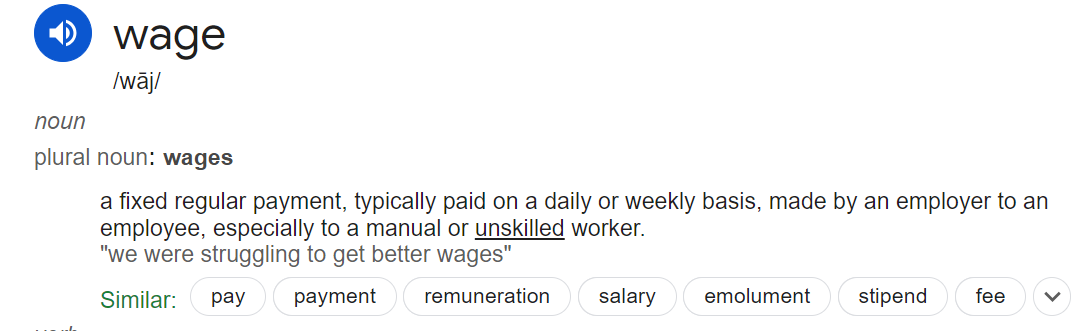

Wages

A fixed regular payment, typically paid on a daily or weekly basis, made by an employer to an employee, especially to a manual unskilled worker.

Up to this 1898, wages has been as it states in the 1898 definition, a compensation paid for labor. It was never considered a gain to the person to whom it was paid.

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

Amendment 16 grants to Congress, the power to tax Incomes, from whatever source derived.

A power not granted to Congress is the power to define what is income. Congress possesses no authority to define what is income. Only to tax that which is. Therefore; Congress is not authorized the power to include —Wages; and tax it as though it were income.

With respect to labor, income is "the gain which proceeds from labor" (1898 definition). When the employer receives more value than the value the employer pays to the employee; the employer has gained from ther employee's labor. The employer, then, owes income tax on that gain from their employees' labor.

With respect to labor, wages is "the compensation for labor"; (1898 definition). Wages, therefore, are not income, because they are not a gain to the employee. The Constitution of the United States of America does not grant a direct tax or any other tax on wages. Wage tax, is therefore, unjust and unconstitutional.

Power expressly prohibited to Congress when taxing income; is that Congress is prohibited from using a census and from using an enumeration.

These prohibitions open up some really interesting probabilities for funding government; discussed in the next page.

When the government uses an unconstitutional way of adjusting or redefining words used in The Constitution; This directly violates the Article 5 Amendment process. In violating The Constitution, Congress commits treason, as detailed in Article 3, Section 3.

Yes. The Constitution of the United States of America is a "living" document, in that it is supposed to be kept current with an ever-changing society. That is the purpose for Article 5. That amendment process does not include the use of more modern dictionaries to redefine constitutional content to make it appear as though congressional actions comply with constitutional restraints. If an error of omission was made in the Constitution, at the time it was ratified; simply propose another amendment to clear up the matter.

Replacing the Unconstitutionally applied Income & Wage Tax

to get Equality With Taxation

The governed people, are intended to work together to properly control their government's powers to equally protect each other's rights.

Share any content within this website. Get others talking about —Getting & Keeping Clean Honest Government.

[End Page Content]

To move all ads to bottom of screen, shrink the window width

Help make it happen!

Help spread the word!