Stop the Unconstitutional Wage Tax

This page changed with the Apr 05, 2024 edit.

To move all ads to bottom of screen, shrink the window width

Be part of the success!

Help spread the word!

This page changed with the Apr 05, 2024 edit.

Both of them are tied to The Constitution of the United States of America, Amendment 16; which states:

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

By definition; both wages and income are ties to labor, as we see in the following two definitions from 1828 and 1898.

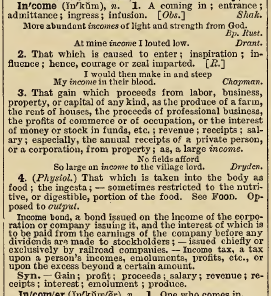

Income

1. That gain which proceeds from labor, business or property of any kind; the produce of a farm; the rent of houses; the proceeds of professional business; the profits of commerce or of occupation; the interest of money or stock in funds. [...]

Notice: The gain which proceeds from labor... the profits of commerce or of occupation... the interest of money... the gain of private persons. Notice what is not here; yet. No mention of wages or salary, both connected to labor.

Income

3. The gain which proceeds from labor, business, property, or capital of any kind, as the produce of a farm, the rent of houses, the proceeds of a professional business, the profits of commerce or of occupation, or the interest of money or stocks in funds, etc.;[...]

Notice: The gain which proceeds from labor... the profits of commerce or of occupation... the interest of money...

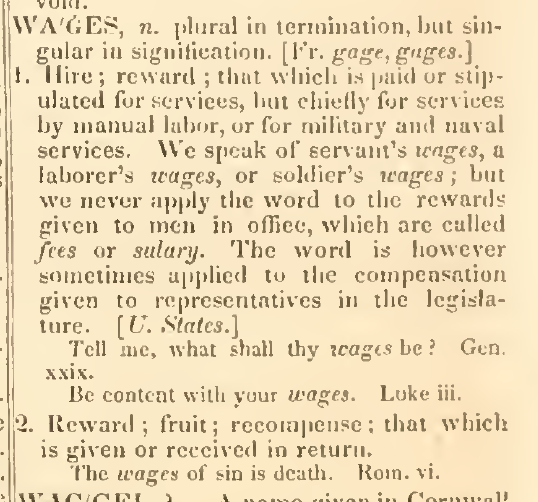

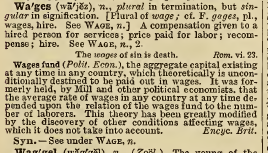

Wages

1. Hire; reward; that for which is paid or stipulated for services, but chiefly for services by manual labor, or for military and naval services. [...]

Wages

A compensation given to a hired person for services; price paid for labor; recompense; hire. See Wage, n. #2

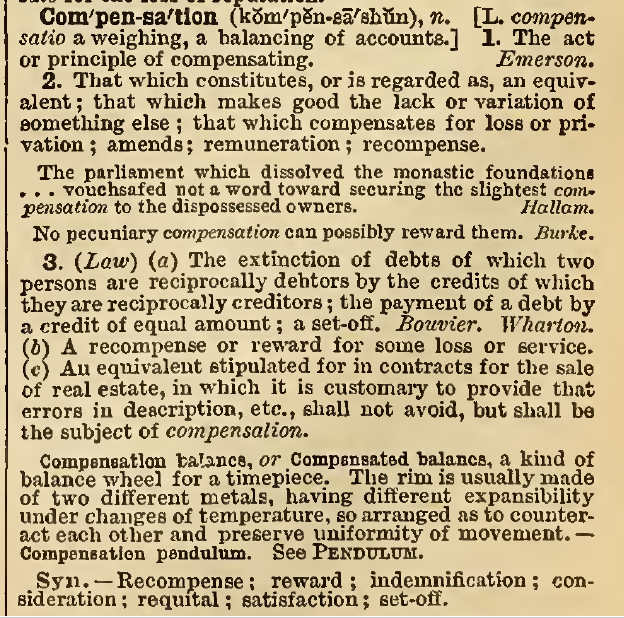

Compensation

2. That which constitutes, or is regarded as, an equivalent; that which makes good the lack or variation of something else; that which compensates for loss or privation; amends; remuneration; recompense.

Note: Wages, so far, is nothing more than the employer repaying a debt to the employee for the labor they provided to the employer. Rarely does the employer make an equivalent return in cash for the services performed by the employee. Employees are rarely compensated the full value of the labor they perform. As such, the employee works to a financial loss, in comparison to the value of service provided.

Up to this 1898, wages has been as it states in the 1898 definition, a compensation paid for labor. It was never considered a gain to the person to whom it was paid.

Amendment 16 grants to Congress, the power to tax Incomes, from whatever source derived.

A power not granted to Congress is the power to define or re-define what is income. Congress possesses no authority to define what is income; only to tax that which is a gain. Therefore; Congress is not authorized the power to include —Wages; and tax it as though it were a form of gain to the employee.

With respect to labor, income is "the gain which proceeds from labor" (1898 definition). When the employer receives more value from the employee labor; it is the employer who has gained from the labor received. The employer, then, owes income tax on that gain from their employees' labor.

With respect to labor, wages is "the compensation for labor"; (1898 definition). Wages, therefore, are not income, because they are not a gain to the employee. The Constitution of the United States of America does not grant a direct tax or any other tax on wages. Wage tax, is therefore, unjust and unconstitutional.

Yes. The Constitution of the United States of America is a "living" document, in that it is supposed to be kept current with an ever-changing society. That is the purpose for Article 5. That amendment process does not include the use of more modern dictionaries to redefine constitutional content to make it appear as though congressional actions comply with constitutional restraints. If an error of omission was made in the Constitution, at the time it was ratified; simply propose another amendment to clear up the matter.

The governed people, are intended to work together to properly control their government's powers to equally protect each other's rights.

Share any content within this website. Get others talking about —Getting & Keeping Clean Honest Government.

[End Page Content]

To move all ads to bottom of screen, shrink the window width

Help make it happen!

Help spread the word!